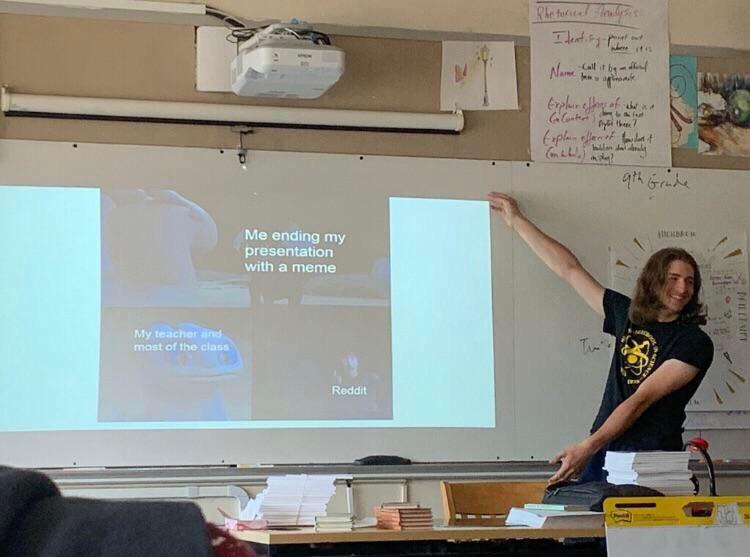

1. Retirement Age Considerations

Image Source: Reddit

Determining your retirement age is one of the first decisions you'll face as you approach retirement. While the traditional retirement age has been 65, many factors can influence your decision. Consider factors such as your health, financial situation, and personal preferences.

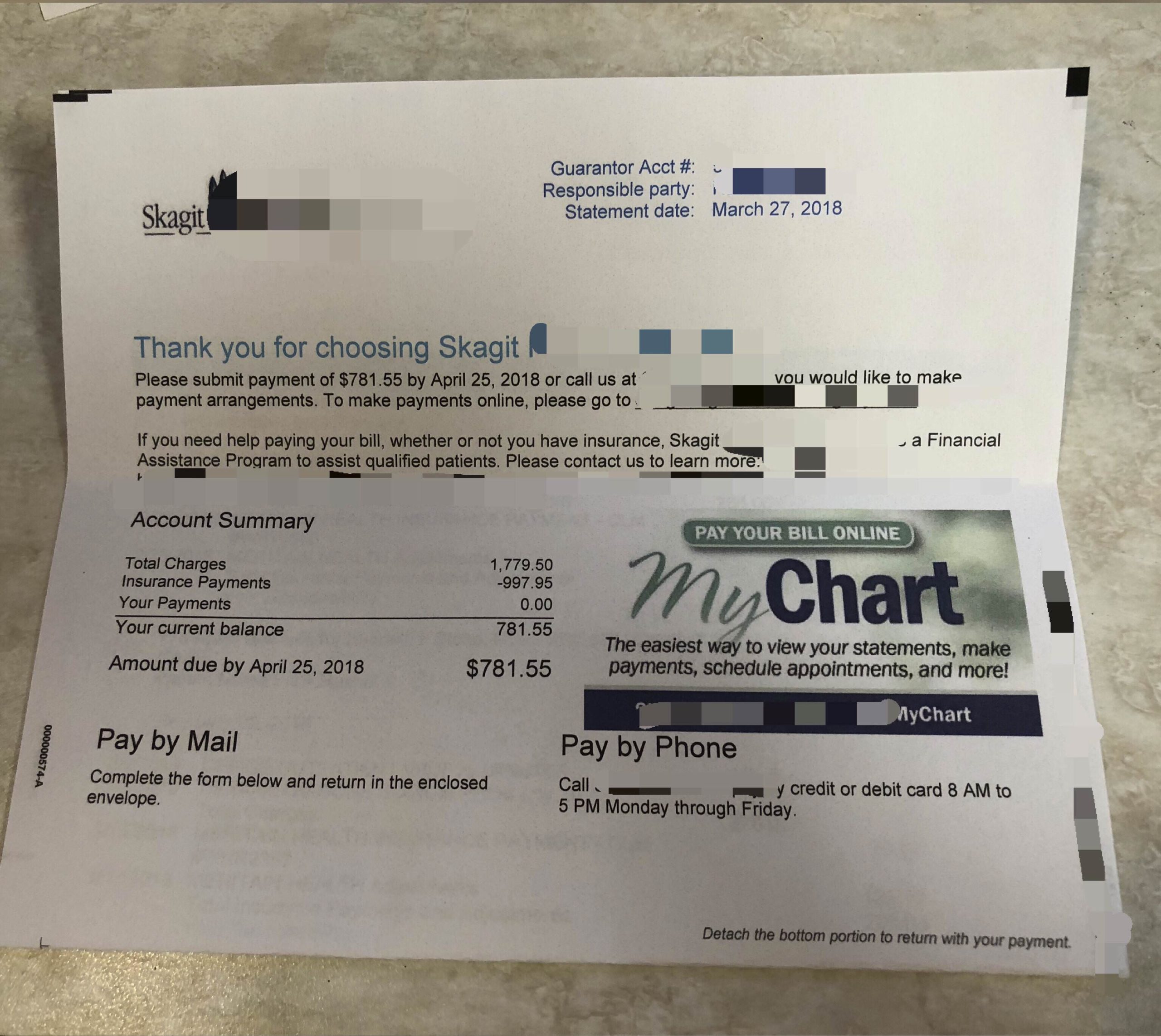

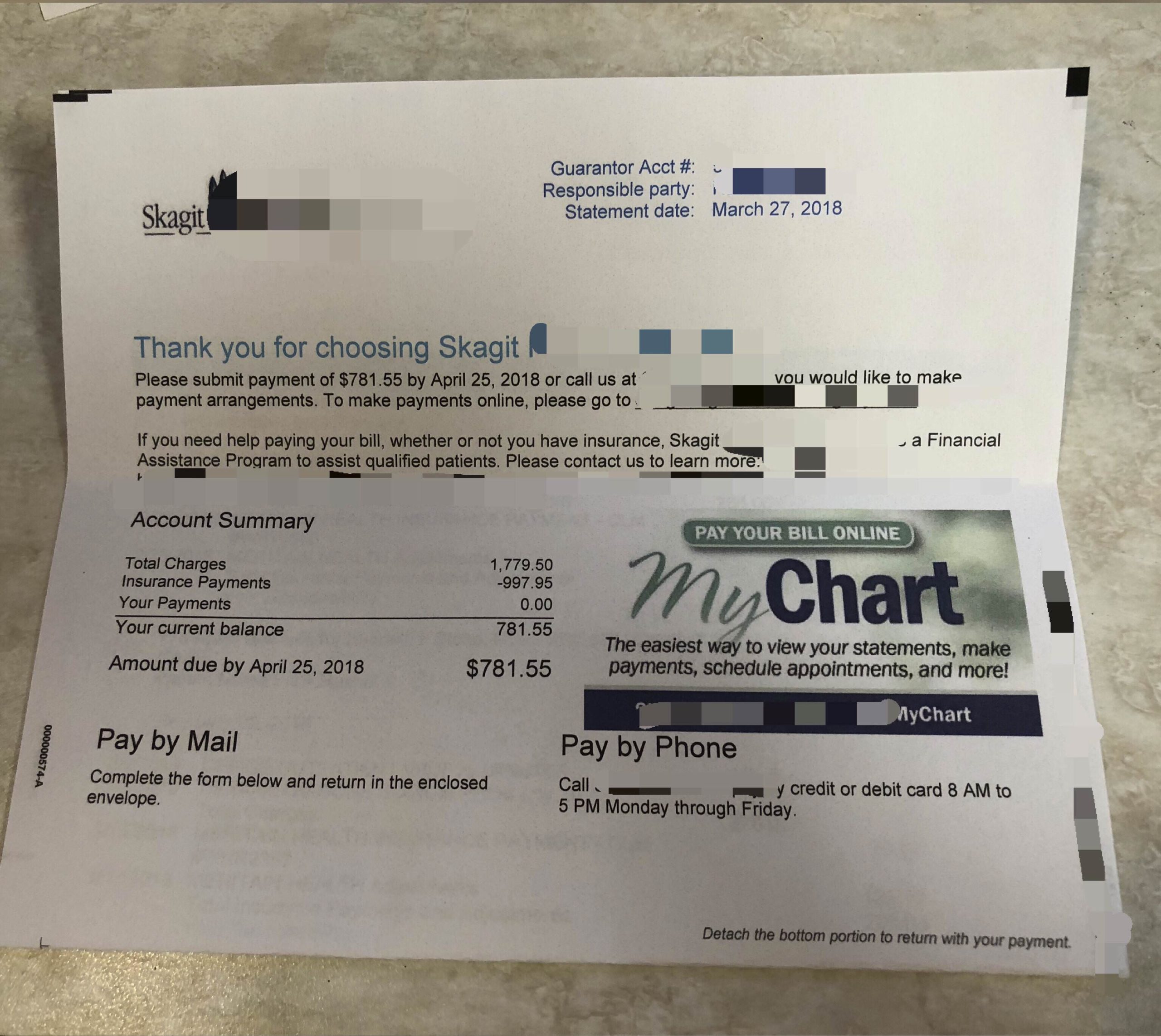

2. Healthcare Coverage and Planning

Image Source: Reddit

Healthcare is a significant concern for retirees. Medicare, the federal health insurance program for people aged 65 and older, will be a primary source of coverage for many retirees. However, it's essential to understand the nuances of Medicare, including the various coverage options.

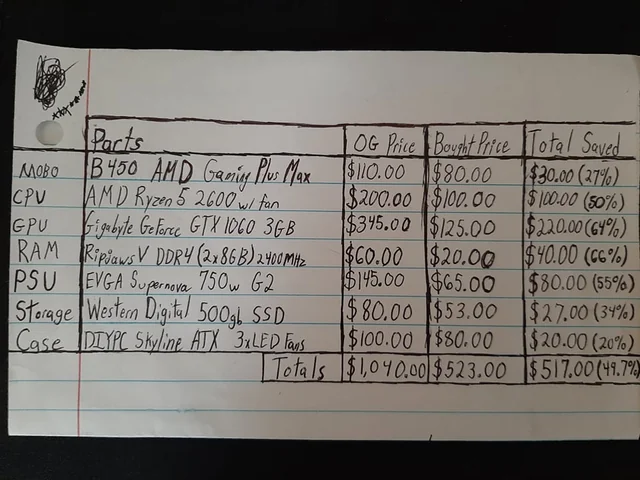

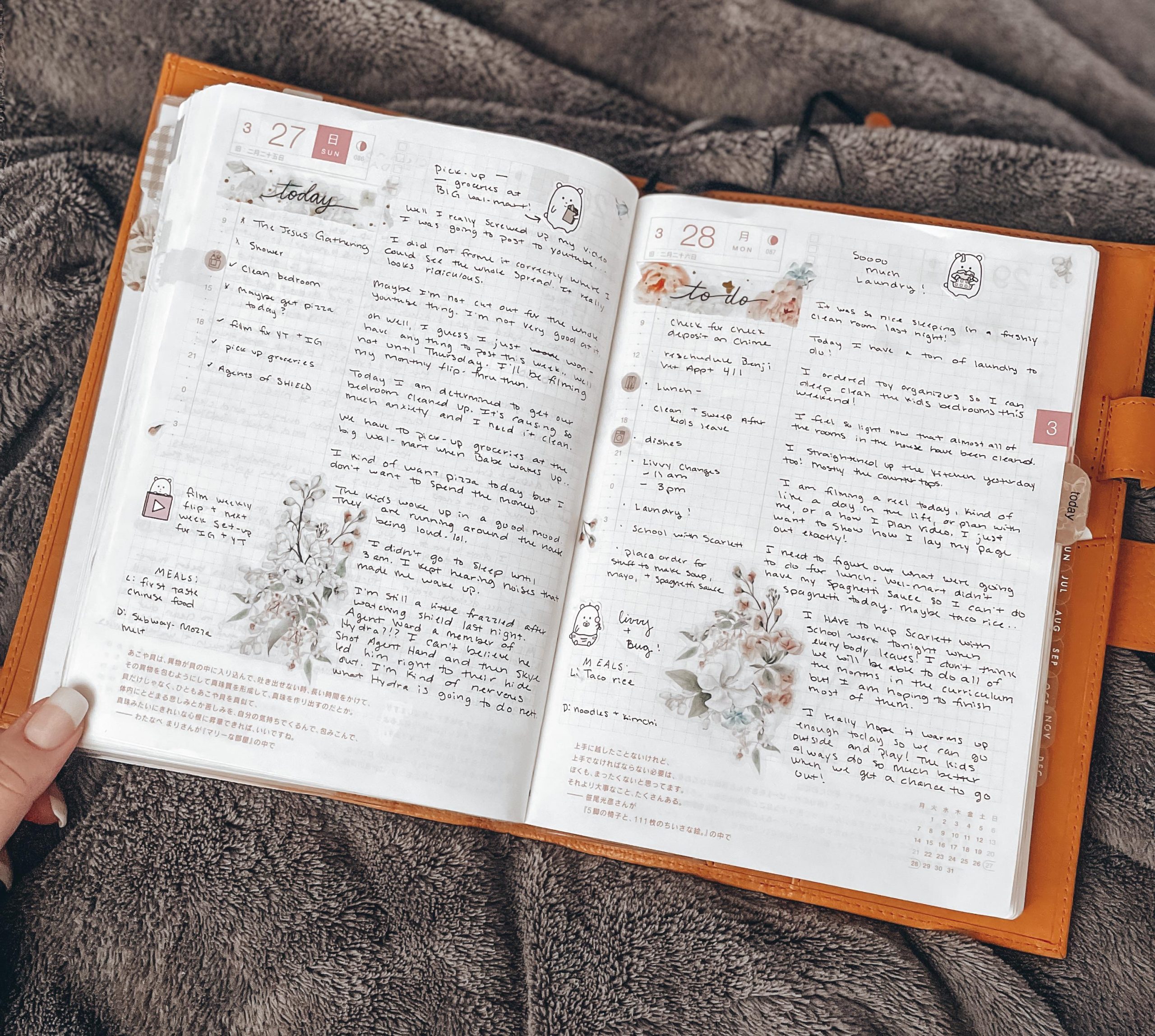

3. Retirement Budgeting

Image Source: Reddit

Creating a comprehensive retirement budget is essential to maintaining financial stability during retirement. Start by assessing your expected sources of income, such as Social Security. Next, determine your anticipated expenses, including housing, utilities, healthcare, travel, and leisure activities.

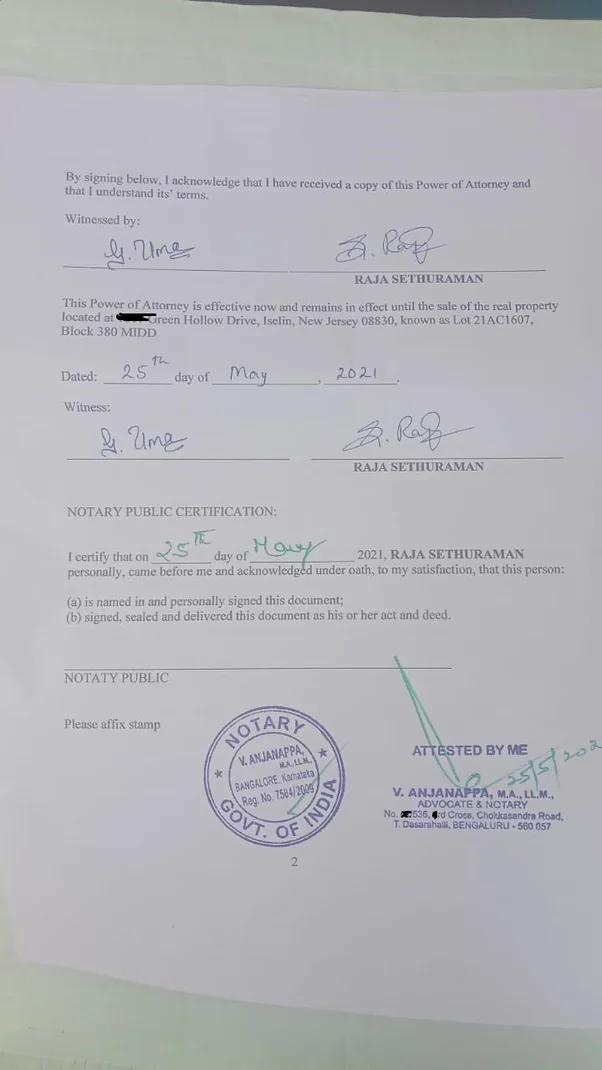

4. Estate Planning

Image Source: Reddit

Estate planning is for everyone, both the wealthy and poor; it's a crucial aspect of retirement preparation for everyone. A well-structured estate plan ensures your wishes are respected regarding asset distribution and minimizes the burden of estate taxes and probate for your loved ones.

5. Social Security Benefits

Image Source: Reddit

If you want to maximize your retirement income, you must understand your Social Security benefits. Although you can begin collecting Social Security payments as early as age 62, your monthly payout will be lower than it would be at full retirement age.

6. Long-Term Care Planning

Image Source: Reddit

Long-term care is a crucial aspect of retirement planning. Long-term care includes services and support needed for individuals who can no longer perform everyday activities independently due to chronic illness, disability, or cognitive decline. These services may not be fully covered by health insurance.

7. Housing Options

Image Source: Reddit

As you approach retirement, it's essential to evaluate your housing situation. Consider whether your current home is suitable for your retirement years or if you should downsize, move to a more accessible location, or explore retirement communities. Consult with a retirement planner to explore the best housing options.

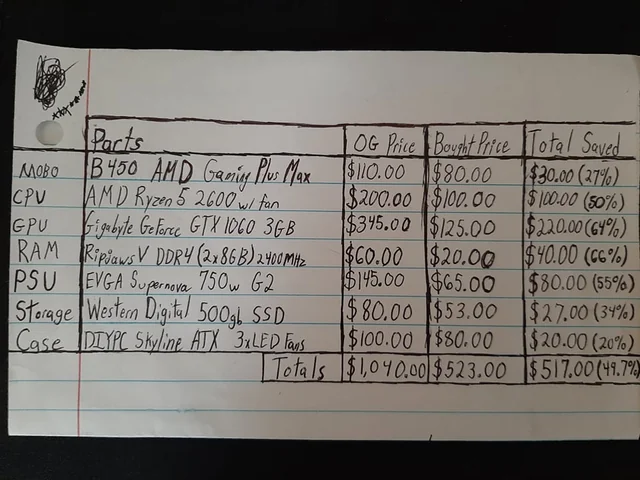

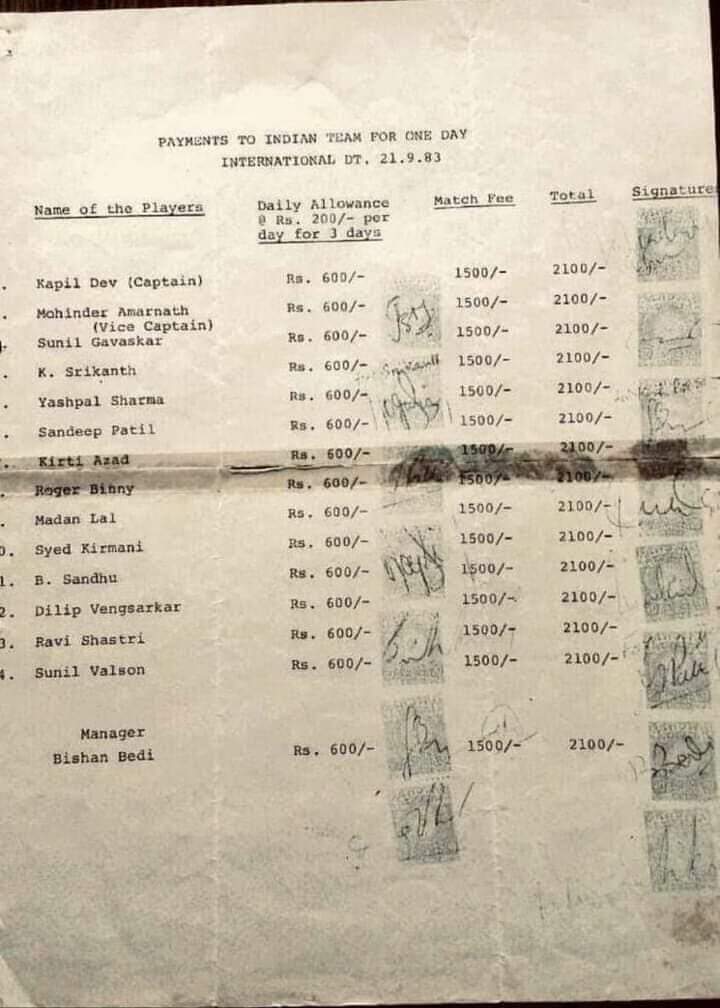

8. Retirement Account Strategies

Image Source: Reddit

Optimizing your retirement accounts is critical for ensuring a secure financial future. Evaluate your retirement account strategies, including 401(k)s, IRAs, and other investment vehicles. Factor in asset allocation, risk tolerance, and tax implications when managing your retirement accounts.

9. Debt Management

Image Source: Reddit

Managing and reducing debt before retirement can significantly impact your financial security during your golden years. High-interest debts, including credit card debts and individual loans, can erode your retirement savings if not addressed. Develop a plan to pay down high-interest debts.

10. Investment Portfolio Adjustments

Image Source: Reddit

As you transition into retirement, adjusting your investment portfolio to reflect your changing financial goals and risk tolerance is essential. Many retirees shift towards a more conservative investment strategy. Set aside retirement funds for income-generating investments, such as bonds.

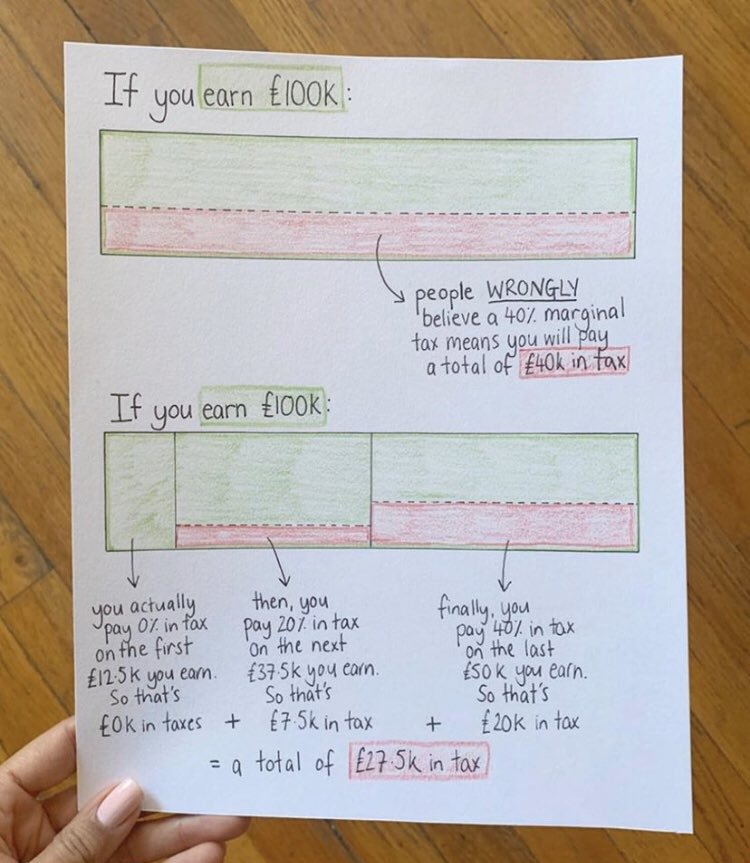

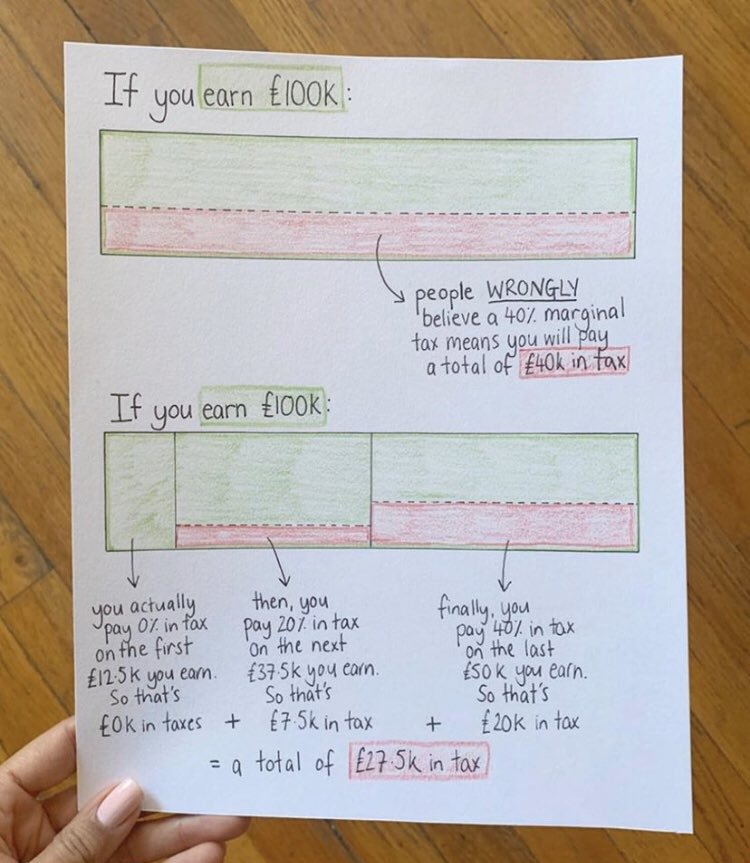

11. Tax Planning for Retirement

Image Source: Reddit

Tax planning is a critical element of retirement planning that can significantly impact your income during retirement. Understanding the tax implications of different retirement income sources is essential. Additionally, explore tax-advantaged retirement accounts, such as Roth IRAs, which can provide tax-free income in retirement.

12. Advance Healthcare Directives

Image Source: Reddit

As part of comprehensive retirement planning, addressing your healthcare wishes and preferences in advance is essential. Wills and power of attorney for healthcare allow you to make decisions about your health. Select a friend or member of your family who, in the event of your incapacitation, can make healthcare choices on your behalf.

13. Staying Socially Engaged

Image Source: Reddit

Retirement often involves a significant change in daily routines and social interactions. Staying socially engaged is vital for maintaining mental and emotional well-being during retirement. Seek out social activities and join clubs or organizations to connect with others.

14. Cultivating Hobbies

Image Source: Reddit

Retirement is a chance to seek out new interests or reawaken passions you may have set aside during your working years. Cultivating hobbies brings joy and purpose to your retirement. Whether gardening, painting, cooking, or learning a new musical instrument, pursuing activities that bring you fulfillment can lead to a more satisfying retirement.

15. Travel Plans

Image Source: Reddit

Travel is a common aspiration for many retirees. Start by creating a travel budget, including transportation, accommodation, food, and activities. Consider whether you'll be traveling domestically or internationally, and account for potential currency exchange rates and travel insurance.

16. Volunteering Work

Image Source: Reddit

Retirement doesn't necessarily mean the end of productive and fulfilling work. Many retirees find purpose and enjoyment in volunteering or pursuing part-time work opportunities. Volunteering allows you to give back to your community, while part-time work can provide supplemental income and social engagement.

17. Legacy Planning

Image Source: Reddit

Legacy planning involves deciding how you want to pass on your assets to future generations. This includes creating or updating your will, establishing trusts, designating beneficiaries, and making charitable donations. Legacy planning also provides tax benefits for your heirs.

18. Insurance Coverage Review

Image Source: Reddit

Reviewing your insurance coverage is a crucial step in retirement planning. Ensure you have sufficient health insurance, including long-term care insurance and Medicare supplements. Reevaluate your life insurance needs, as they may have changed with your financial situation and family dynamics.

19. Emergency Fund Essentials

Image Source: Reddit

Even in retirement, having an emergency fund is essential. Unforeseen expenses or emergencies can arise at any age, and having a financial cushion can protect your retirement savings. Keep this fund in a liquid, easily accessible account, such as a high-yield savings account.

20. Accounting for Inflation

Image Source: Reddit

Inflation poses a danger to your retirement savings. When the cost of living tends to rise, it reduces the purchasing power of your money. When calculating your retirement income and expenses, take inflation into account. Invest in stocks and real estate to help your retirement savings grow over the long term.

21. Prioritizing Health and Wellness

Image Source: Reddit

Health is wealth, and it's crucial to prioritize your physical and mental well-being in retirement. Stay healthy by exercising, eating a balanced diet, and getting regular check-ups. Consider engaging in yoga, meditation, or mindfulness activities to reduce stress and promote overall wellness.

22. Maximizing Social Security

Image Source: Reddit

To maximize your Social Security benefits, understand the rules regarding when to claim benefits. Delaying your claim until full retirement age or even until age 70 can result in larger monthly payments. Coordinate Social Security claiming strategies with your spouse to optimize your household's benefits.

23. Financial Advisor Benefits

Image Source: Pinterest

A retirement plan that is customized to your needs can be created with the help of a financial counselor. You may make informed decisions regarding your retirement funds and tax planning and build investing plans with the assistance of financial experts.

24. Legacy Letters to Loved Ones

Image Source: Reddit

Legacy letters are heartfelt documents that allow you to share your wisdom, values, and sentiments with loved ones. These letters can comfort and guide your family and friends and help them understand your wishes for the future. Consider writing these letters to express appreciation and share life lessons with those you care about most.

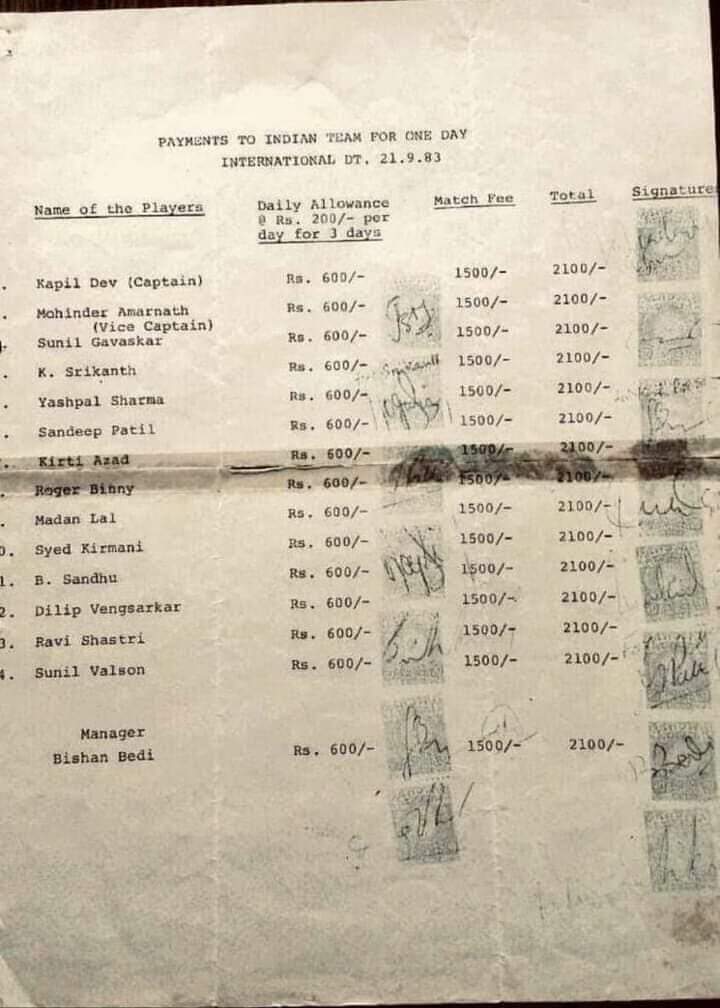

25. Understanding Pension Benefits

Image Source: Reddit

If you have a pension plan through your employer, it's crucial to understand how it works. Review your pension plan's terms, such as payment options and survivor benefits. Coordinate your pension benefits with other sources of retirement income, such as personal savings, to create a comprehensive retirement strategy.

26. Defining Retirement Lifestyle

Image Source: Reddit

Retirement offers the opportunity to shape your lifestyle to align with your dreams and goals. Take the time to define what your ideal retirement lifestyle looks like. Consider factors such as where you want to live, the activities you want to pursue, and how you want to spend your time.

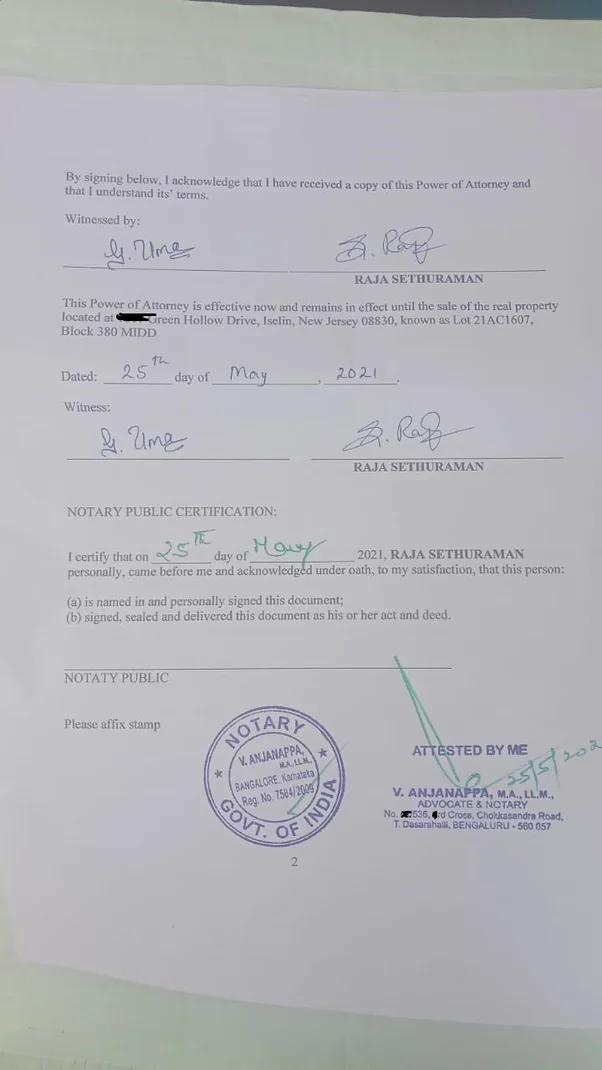

27. Legal Document Preparation

Image Source: Reddit

Preparing essential legal documents is a crucial step in retirement planning. Beyond wills and advance healthcare directives, consider other legal documents, such as a power of attorney for financial matters. This document designates someone to handle your financial affairs if you cannot do so.

28. Aging in Place

Image Source: Reddit

Aging in place means living in your home and community comfortably and safely as you age. Evaluate your home for potential modifications to accommodate aging, such as installing grab bars, widening doorways, or adding ramps. Consider the availability of healthcare facilities that can support your needs as you age.

29. Embracing Enjoyment in Retirement

Image Source: Reddit

Retirement should be about more than just financial security; it's also an opportunity to embrace enjoyment and fulfillment. Make a list of the activities, hobbies, and experiences that bring you joy, and prioritize them in your retirement plan, such as taking up a new sport.

30. Financial Preparedness

Image Source: Reddit

Financial preparedness is a continuous process that involves monitoring and adjusting your financial plan as circumstances change. Regularly review your retirement accounts, investment portfolio, and budget to ensure they align with your retirement goals.