1. They're Expensive

image source: reddit.com

Probably the most obvious reason not to buy a house, is that they're expensive. The housing market at the minute means that many first time potential buyers just can't afford to get on the property ladder, and they don't seem to be getting any cheaper!

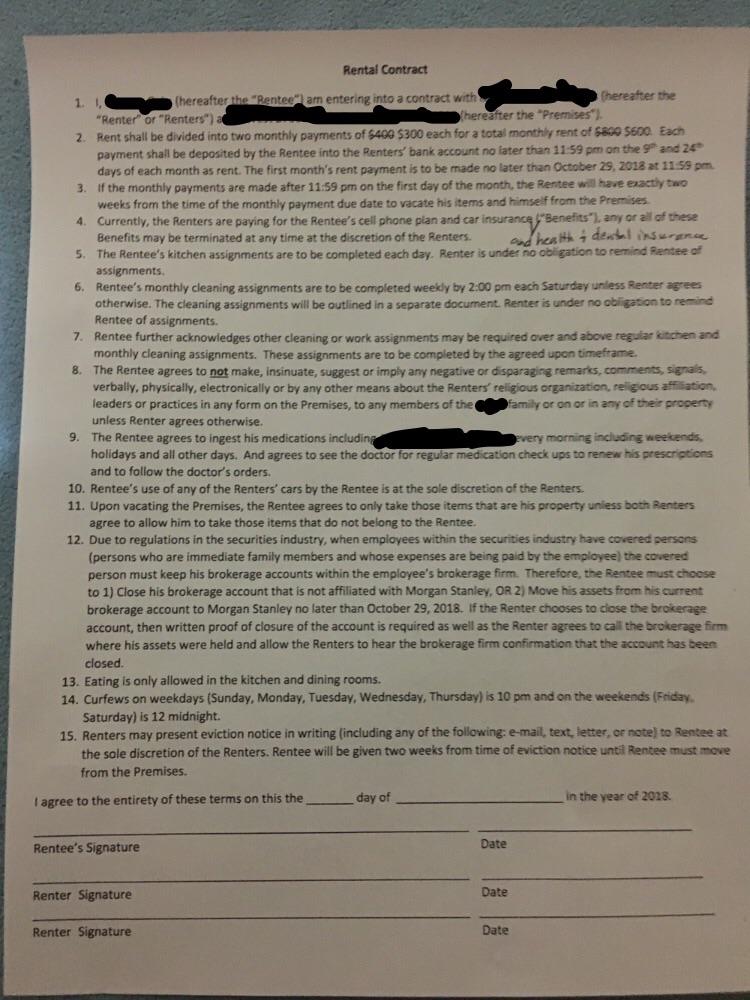

2. You'll Be Tied To A Mortgage

image source: reddit.com

Chances are, unless you're lucky enough to be a cash buyer, you will have to get a mortgage in order to buy a house. Mortgage payments are no joke and must be kept up with if you want to keep your house. Not to mention you'll be tied to this debt for at least 20 years!

3. The Process Of Buying Is Draining

image source: reddit.com

Financially, energetically, mentally; house buying drains all of your resources and then some. It's a long, drawn out process which usually leaves you burnt out. People don't always realize just how exhausting and demoralizing shopping for houses is - it's not all glamorous viewings!

4. It's Hard To Save For A Down Payment

image source: pinterest.co.uk

Down payments are the first of many costs when it comes to purchasing your first home, and a large sum is usually required. You may get lucky and come into a bit of money, but if all of your money is going into rent and bills, then that big number may seem very daunting indeed.

5. You Don't Have A Landlord For Maintenance

image source: reddit.com

Landlords quite rightly get a bad rap; they take all of your money and sometimes can be unreliable, however they are there for general maintenance! When you own a house, its upkeep is your responsibility, which can be very expensive and very time consuming.

6. You Can't Just Move Whenever You Want

image source: reddit.com

When you're renting, it's relatively easy to pack all of your things and move house if you get tired of where you live, but it's not so easy when you own the place. It's a huge commitment to choose an area you're going to live in for the foreseeable, and you may not know what it's really like until you live there!

7. You're Less Likely To Travel

image source: reddit.com

Being stuck with a mortgage and bills, you're much less likely to travel; you'll have less disposable income and everything still needs to be paid while you're away. Unless you decide to sell, you have no choice but to pay housing costs so you can kiss seeing the world goodbye!

8. Decorating

image source: reddit.com

Not many people enjoy the decorating process; it's expensive, time consuming, messy and downright annoying. You'll lose the use of the rooms you're renovating and you may discover that they need a lot more work than you initially thought; and it's on you to finish it!

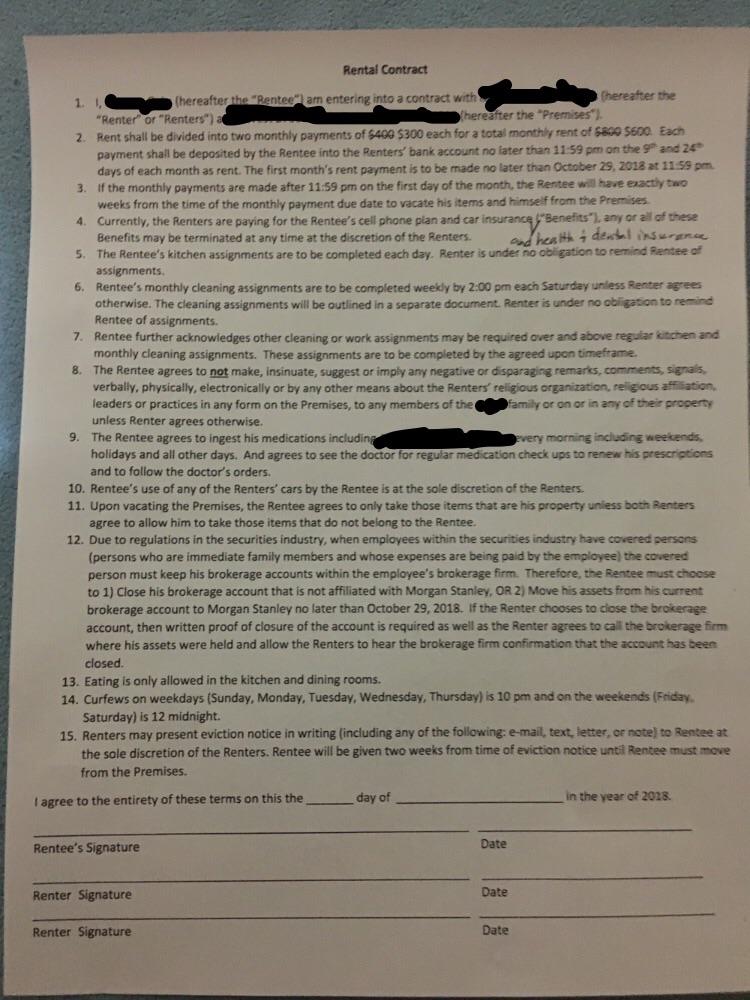

9. No Flexibility

image source: reddit.com

Once you've bought a house, you're in. You can't be flexible to leave when you want, and you have to remain employed otherwise you may not be able to pay. This great responsibility means that everything has to remain secure, otherwise you're liable for all sorts of claims, even prosecution!

10. You Have To Do A Lot Of Research

image source: reddit.com

Estate agents are renowned for embellishing the truth so that they get a sale, so you have to do your own research on houses and areas, to make sure you're getting a good deal. It requires a ton of research, and looking at the admin can be quite difficult to understand. Ensure to enlist some who speaks legalese!

11. You Have To Be Ready To Settle Down

image source: reddit.com

Settling down can look quite attractive in theory, but in practice it may be scarier and less alluring than originally thought. You have to be absolutely 100% certain that you wish to settle down when buying a house, as changing your mind will cost you a lot more than money!

12. The Housing Market Is Unreliable

image source: reddit.com

Some people see buying a house as a great investment, but what they don't take into consideration is just how unreliable such an investment may be. The housing market is so fickle in that you could quite easily lose money, so it isn't always a great idea to buy for this reason!

13. It's Stressful

image source: reddit.com

They say that moving house is one of the most stressful things you can do in your life, even more stressful than having a baby. When you buy a property there are so many twists and turns that you will end up feeling stressed for a very long time as the sale processes, and also after it's finalized.

14. High Interest Rates

image source: reddit.com

When you take out a mortgage, it takes a lot to even start paying it back as the interest rates are so high. It's sickening that you're paying thousands of dollars just for the luxury of having to pay off a loan so that you can live in a house for the next however many years.

15. They're Expensive To Sell

image source: reddit.com

Unless you buy your 'forever home', it's inevitable that you'll sell it eventually. Selling a house takes a long time and a lot of money. It's potentially as stressful if not more so of buying it in the first place, as there are so many hidden costs that you might not consider. That on top of all the disappointing house viewings you have makes it a very unpleasant process.

16. You Might Lose Your Job

image source: reddit.com

Sorry to get hung up on the 'what ifs', but having a commitment as serious as homeownership, relies on your employability for the next 20+ years. It's a serious possibility that you might lose your job at some point in this time, which would be terrifying when you have so many expensive outgoings.

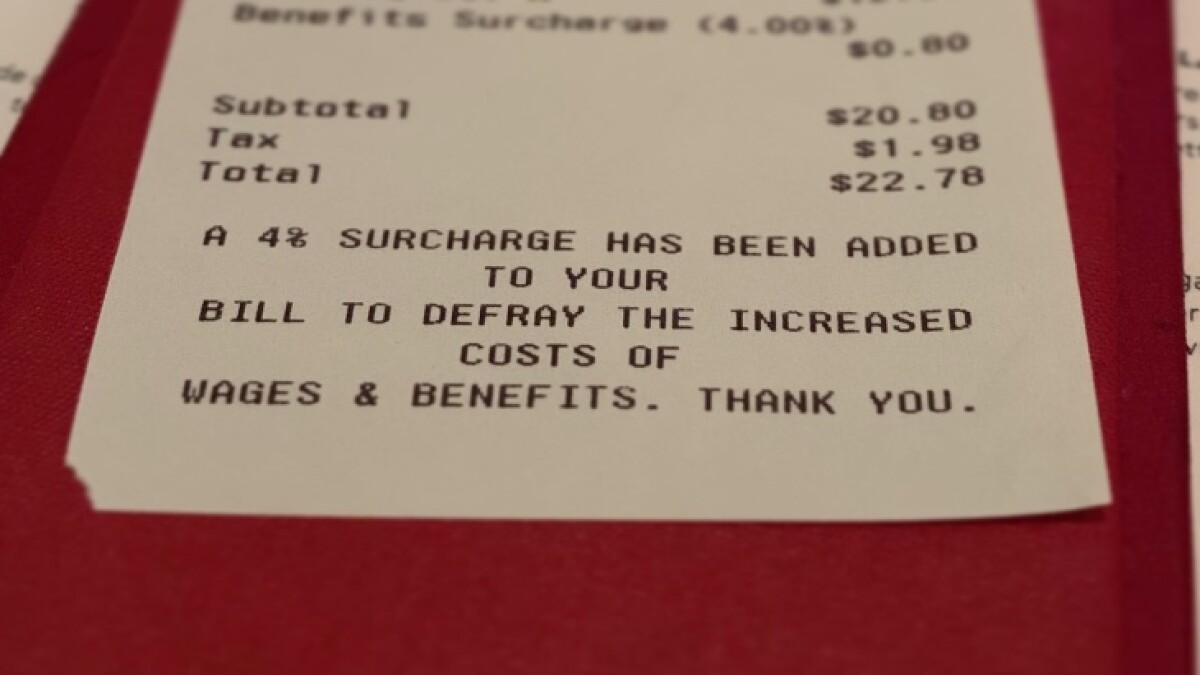

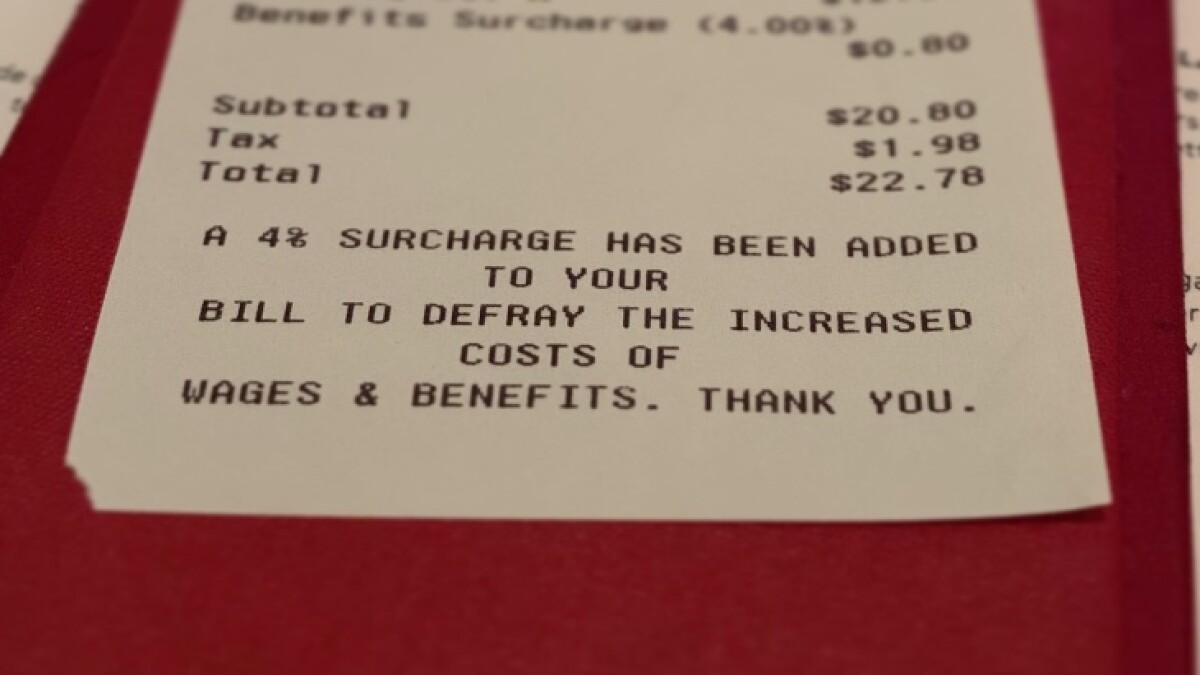

17. Hidden Fees

image source: laist.com

Buying houses is so expensive at the best of times, but you might not realize all of the hidden costs that make up the process. You have to take into account lawyer fees, admin fees, signing off fees, estate agents, just to name a few. They charge you for simply breathing around a house for sale!

18. You Might Regret It

image source: reddit.com

If you regret moving into a rented property, you can just look for another and get out before you've even unpacked your suitcase. That is not the case when you buy a place. If you regret it you're trapped, and it's a very long road out. You have to be willing to take a huge risk when it comes to property ownership.

19. You May Find Better Opportunities Once You've Committed

image source: digitalpeople.blog.gov.uk

There's nothing worse than a better opportunity coming up once you've already parted with your money. This happens all the time with people buying houses, and there's no way of turning back time! Committing to one house can be a nightmare, as you'll always think 'what if'.

20. Your Credit Could Be Poor

image source: reddit.com

It's easy to have poor credit, and you won't be considered for a mortgage if you do. There are ways to increase you credit score, however not everyone want to commit to these techniques. It often requires getting loans out to prove you can pay them back, which only put you in more debt.

21. It May Be Cheaper To Rent

image source: reddit.com

Some mortgages are overpriced, and will have you paying more monthly than you would do if you were still renting. Paying less will leave you with more disposable income so that you can do other things, rather than just simply living in a home which you own.

22. You'll Miss Out While Saving

image source: reddit.com

Saving money requires you to say no to a lot of things, and saving up for a down payment will have you doing this for a very, very long time. You'll miss out on trips, buying a new car; you'll even have to stop buying yourself so many clothes. Who wants to do that for years?

23. You'll Miss Out On Rented Properties' Perks

image source: reddit.com

Many rented places have free-to-use amenities such as gyms, swimming pools and a concierge service, and if you own a house you'll miss out on all of this. It means that there'll be even more added cost in accessing the amenities yourself, and they won't be conveniently on your doorstep.

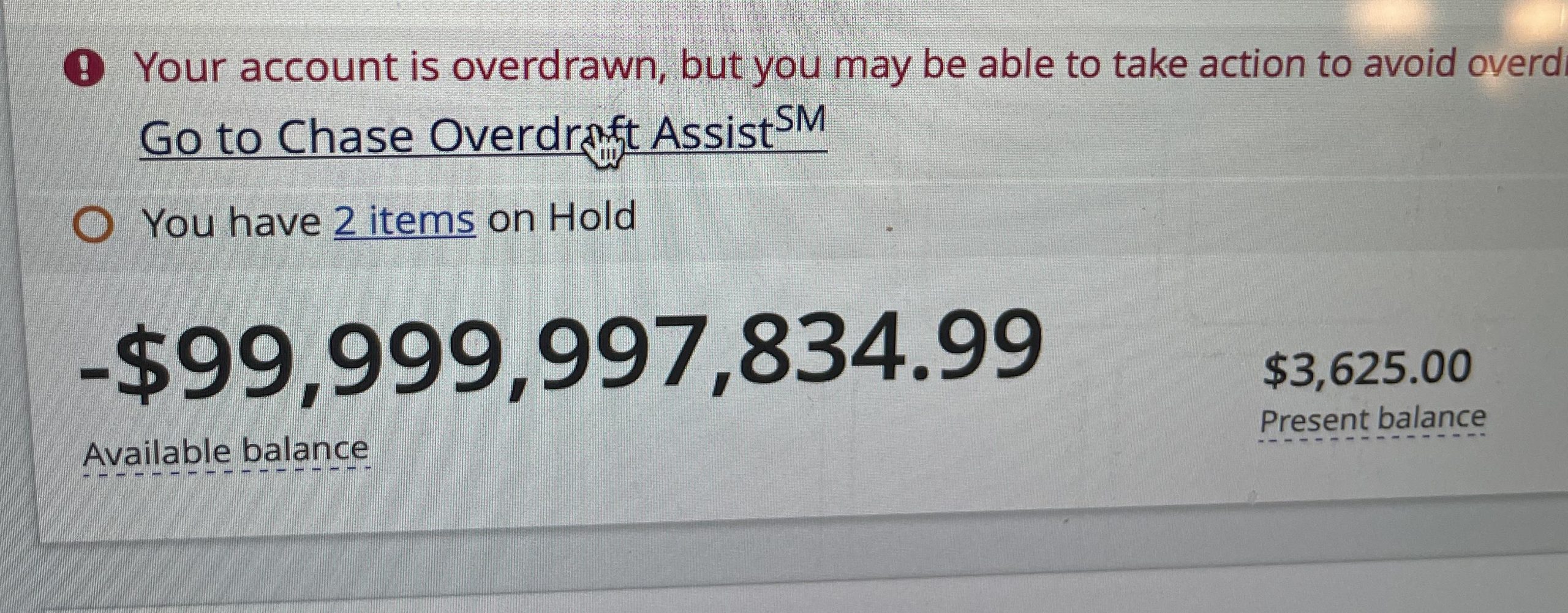

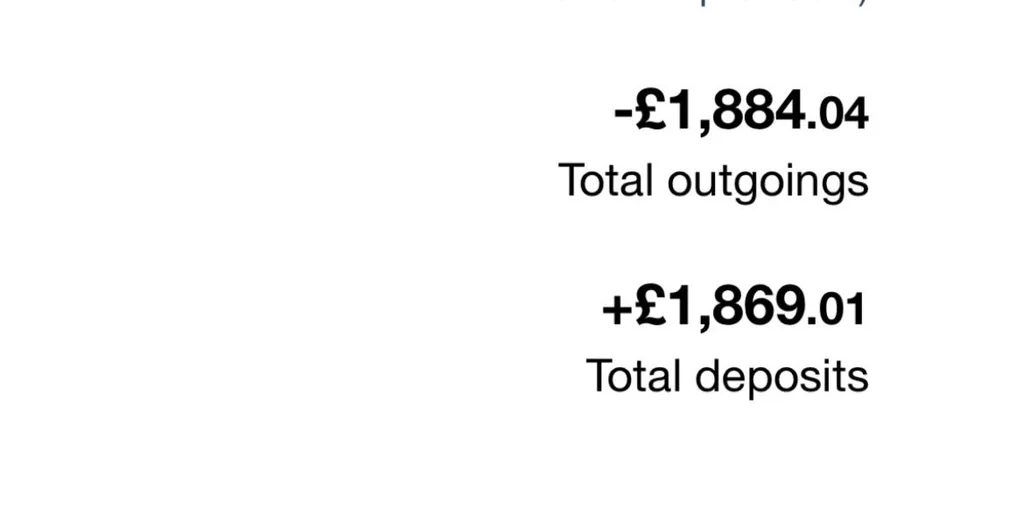

24. You'll Accrue A Lot Of Debt

image source: reddit.com

Buying a house automatically puts you into thousands of pounds worth of debt, which is likely to weigh heavy on your mind (even if you don't realize it). You'll be paying off these debts for possibly the rest of your life. You're literally signing your life away by owning a property

25. Your Relationship Could Decline

image source: huffingtonpost.co.uk

With all the stress of buying a house, you may end up in hot water with your spouse. You then have to live together in close quarters, which is enough to put a strain on any relationship. With the added stress of finances, you need to make sure your relationship is watertight before committing to homeownership.

26. There'll Be Unpredictable Costs

image source: reddit.com

You don't realize just how costly owning a house is until you own one. When you're first starting out, there are so many added costs. As you live in the property you'll find that you need to spend money on way more than you thought you did, which makes it difficult to budget.

27. Responsibility

image source: reddit.com

The responsibility of owning a home isn't just about the mortgage and bills you have to pay, it's also the added responsibility of ensuring the house stays nice for the next person to buy. There may be ongoing structural, internal or external issues that you'll need to sort out.

28. It's Boring

image source: hpkuk.com

Buying a house with the intention of living in the same place for the next few years is dull. It means there will likely be less big exciting surprises in your life as you fall into a stable routine. It will offer you some predictability which for some people is rather boring!

29. You'll Have Less Money

image source: hpkuk.com

Owning a home means that you'll have to be sensible with your money. Your first priority has to be paying your mortgage and bills and what little remains may need to pay for unwelcome surprises! You'll always want to keep some money aside just in case anything goes wrong, which means you'll have less money in the long run.

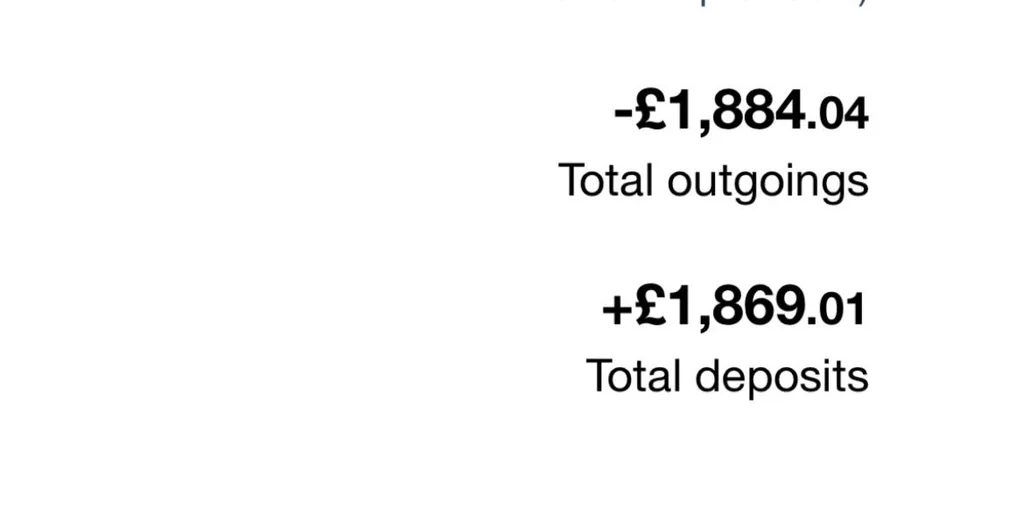

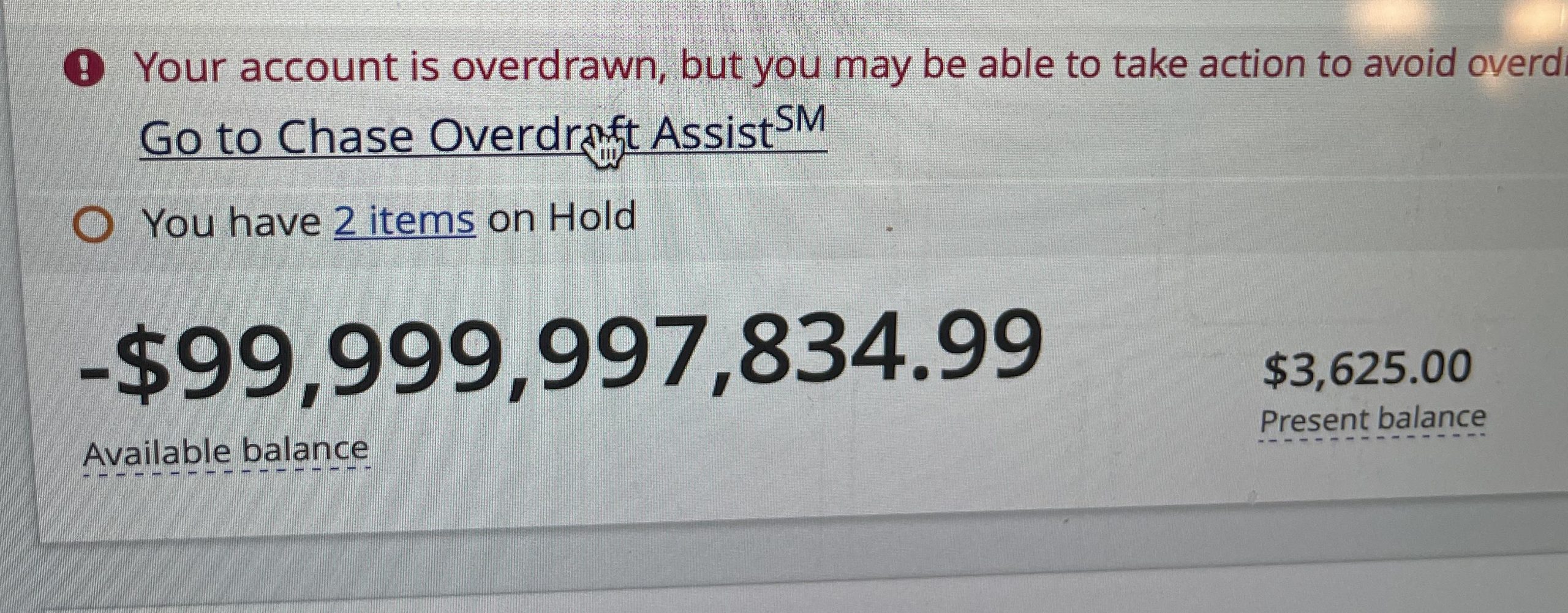

30. Your Outgoings Will Continue To Increase

image source: hpkuk.com

No mortgage comes with a lifetime warranty, and you can expect to see it and its interest rates increase over the coming years. They don't always tell you this when you're just starting out, so make sure you're prepared to see even less money than when you first started paying your mortgage!